Medical electronics sales to grow to $50.9bn

Medical electronics sales will grow 8% to about $50.9 billion in 2014 after rising just 3% in 2013 to an estimated $47.3 billion, predicts IC Insights.

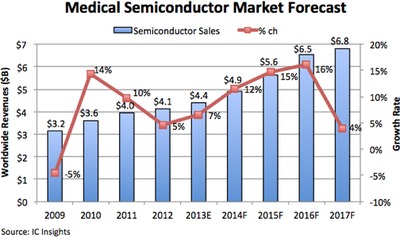

Sales of semiconductors used in medical systems are also expected to gain strength in 2014, rising 12% to $4.9 billion after growing 7% in 2013 to about $4.4 billion, according to IC Insights’ new 2014 edition of IC Market Drivers - A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits.

Worldwide growth in medical electronics is expected to regain strength in the next three years after slowing since 2010 due to the weak global economy and efforts to curb healthcare costs in the US and Europe.

Between 2012 and 2017, worldwide sales of medical electronics are projected to rise by a compound annual growth rate (CAGR) of 7.3%, reaching $65.4 billion in the final forecast year of the 2014 IC Market Drivers report. The brand new medical electronics section in the 475-page report shows semiconductor sales for healthcare systems applications rising by a CAGR of 10.5% and reaching $6.8 billion in 2017 (Figure 1).

In the years ahead, stronger growth in medical electronics will be fuelled by sales of less expensive diagnostic and imaging equipment in China and other developing country markets as well as the explosion of wireless mobile healthcare systems that monitor patients remotely and reduce the need for expensive stays in hospitals. The 2014 IC Market Drivers report forecasts wireless mobile medical systems and closely associated wearable fitness-tracking devices generating revenues of nearly $1.9 billion in 2014, which is a 53% increase from about $1.2 billion in 2013, when worldwide sales grew 27%.

Development trends in medical systems for hospitals, clinics and doctor offices are heading in two different directions as equipment makers respond to growing pressures for lower costs and increased availability of health care in poor and developing countries. One trend is to make new medical diagnostic systems smaller and less expensive so that equipment can be used in the rooms of hospital patients, more clinics and doctor offices versus the dedicated examination rooms in hospitals and imaging centres. Advancements in semiconductor sensors - many of them built with microelectromechanical systems (MEMS) technology - wireless ICs and system-on-chip (SoC) designs are also enabling new types of mobile medical devices that monitor patients and the elderly at home and then relay information to doctors or hospitals via wireless connections to cell phones or the internet.

The other trend highlighted in the new IC Market Drivers report is the creation of more powerful and integrated systems, which are expensive but promise to lower healthcare costs by detecting cancer and diseases sooner while supporting less invasive surgery for quick recovery times and shorter stays in hospitals. Computer-assisted surgery systems, surgical robots and operating-room automation are among new technologies being pursued by some hospitals in developed-country markets.

Developed countries (such as the US, Europe and Japan) have about 18% of the world’s population, but account for nearly 80% of total healthcare spending - approximately $5.3 billion versus $1.4 billion in 178 developing and poor countries during 2012.

The world’s ageing population in both developed and developing countries stands to greatly benefit from new wireless health-monitoring systems and telemedicine services that are aimed at reducing cost and serving more patients. While the large established markets have struggled in recent years, medical equipment sales have been booming in China, which is pursuing an ambitious initiative to significantly upgrade primary health care, hospitals, medical infrastructure and access to medical services in the country’s vast rural regions. China’s investments in medical and healthcare infrastructure are expected to total $63.5 billion this decade. Consequently, China’s share of worldwide medical systems sales is expected to more than double in the next four years, reaching 10% in 2017 versus 4% in 2013, while the market shares of developed countries shrink, according to IC Insights’ new report.

Australia's largest electronics expo returns to Sydney

Electronex, the annual electronics design and assembly expo, will return to Sydney on 19–20...

The fundamentals of Australian RCM compliance

The following information aims to help readers understand the Australian compliance requirements...

Largest ever Electronex Expo in Melbourne

The Electronics Design and Assembly Expo will return to Melbourne from 10–11 May at the...